Banco Inversis, S.A.U. is the global subcustodian of Banco Inversis, S.A.U. Luxembourg Branch.

Banco Inversis, S.A.U. is a fully licensed bank with registered address in Spain and under the supervision of the Bank of Spain and the Spanish Securities Exchange Commission (“Comisión Nacional del Mercado de Valores”). Banco Inversis, S.A.U. is a fully owned subsidiary of Banca March S.A., a private bank with a rating CET 1 of 21.26%.

Upon the provision of its custodial services to Banco Inversis, S.A.U. Luxembourgh Branch, Banco Inversis, S.A.U. is providing such services directly on its behalf in the Spanish markets as a direct participant. With regards other jurisdictions, Banco Inversis, S.A.U. is working with the following network of a highly reputed subcustodians:

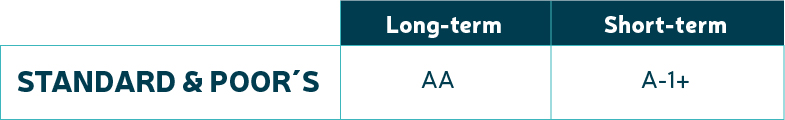

CLEARSTREAM

Clearstream Bank Luxembourg's rating published by Standard & Poor's and Fitch continues to be AA for the long term and A1+ and F1+ respectively for the short term.

Source: https://www.clearstream.com/clearstream-en/about-clearstream/reports-and-ratings

Ratings of Deutsche Börse AG:

Source: https://www.deutsche-boerse.com/dbg-en/investor-relations/share-and-bonds/credit-ratings

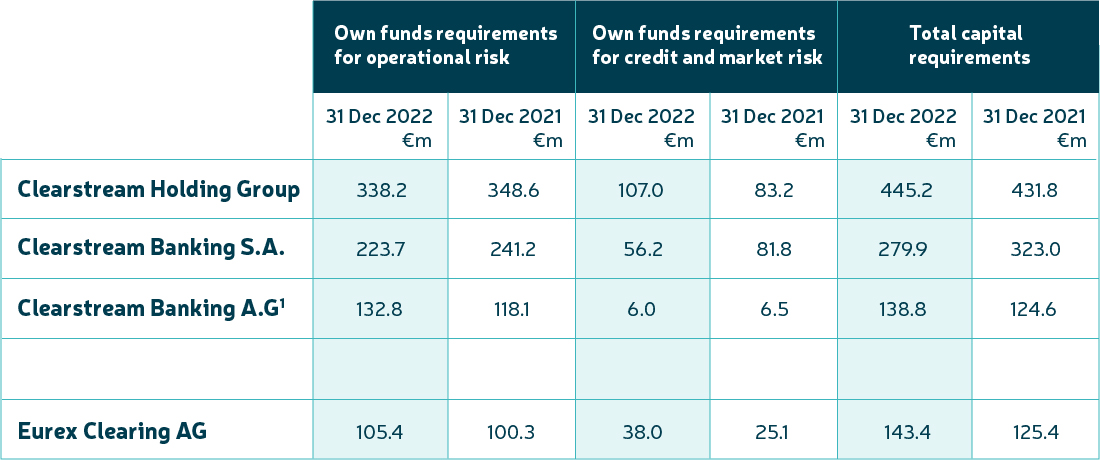

For Clearstream, the solvency ratios of the group and subsidiaries are detailed below:

Composition of own funds requirements:

1) Clearstream Banking AG´s previous year´s figures were updated based on previous-year´s audited financial statements.

Source: Deutsche Börse Group Annual Report 2022.

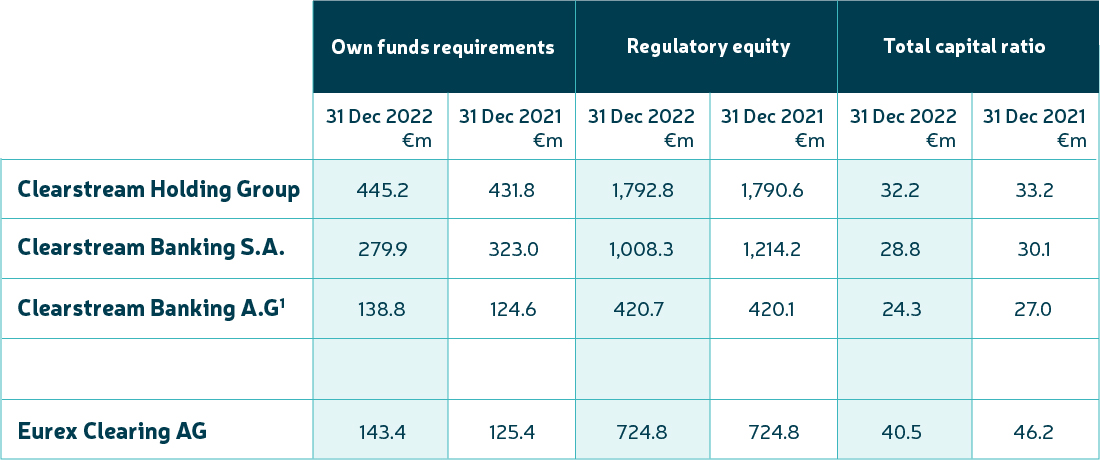

Regulatory Capital Ratios according to CRR:

1) Clearstream Banking AG´s previous year´s figures were updated based on previous-year´s audited financial statements.

2) According to Art. 26 Abs. 1 (a) CRR, capitel instruments must comply with the requirements persuant to Art. 28 CRR. As of 31 December 2021, the profit and lost transfer agreement between Eurex Clearing AG and Eurex Frankfurt AG did not comply with the discretion under Art. 28 (3) (d) CRR. Therefore, the regulatory own funds were reduced subsequently as per 31 December 2021 to the amount of subscribe capital of €25.0 million. Furthermore, previous year´s own funds requirements were adjusted.

Source: Deutsche Börse Group Annual Report 2022.

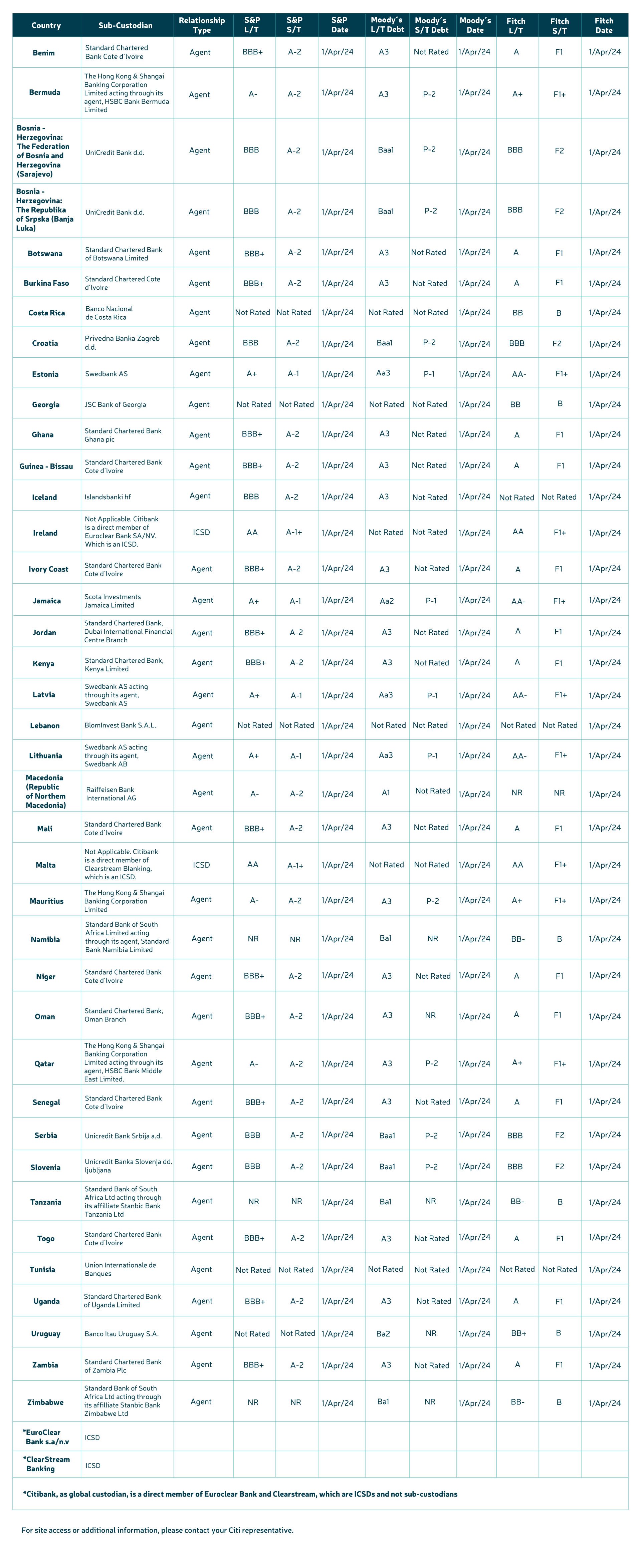

CITIGROUP

In terms of solvency, Citibank had a CET1 ratio of 13.0% at 31 December 2022.

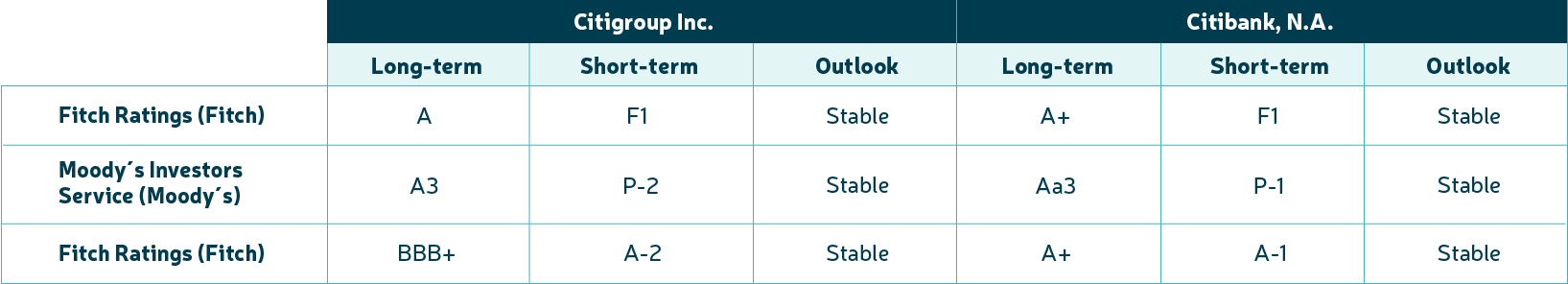

Citigroup's updated rating table is attached. Details of the rating for each jurisdiction are provided in Appendix I.

Source: Citigroup Annual Report 2022.

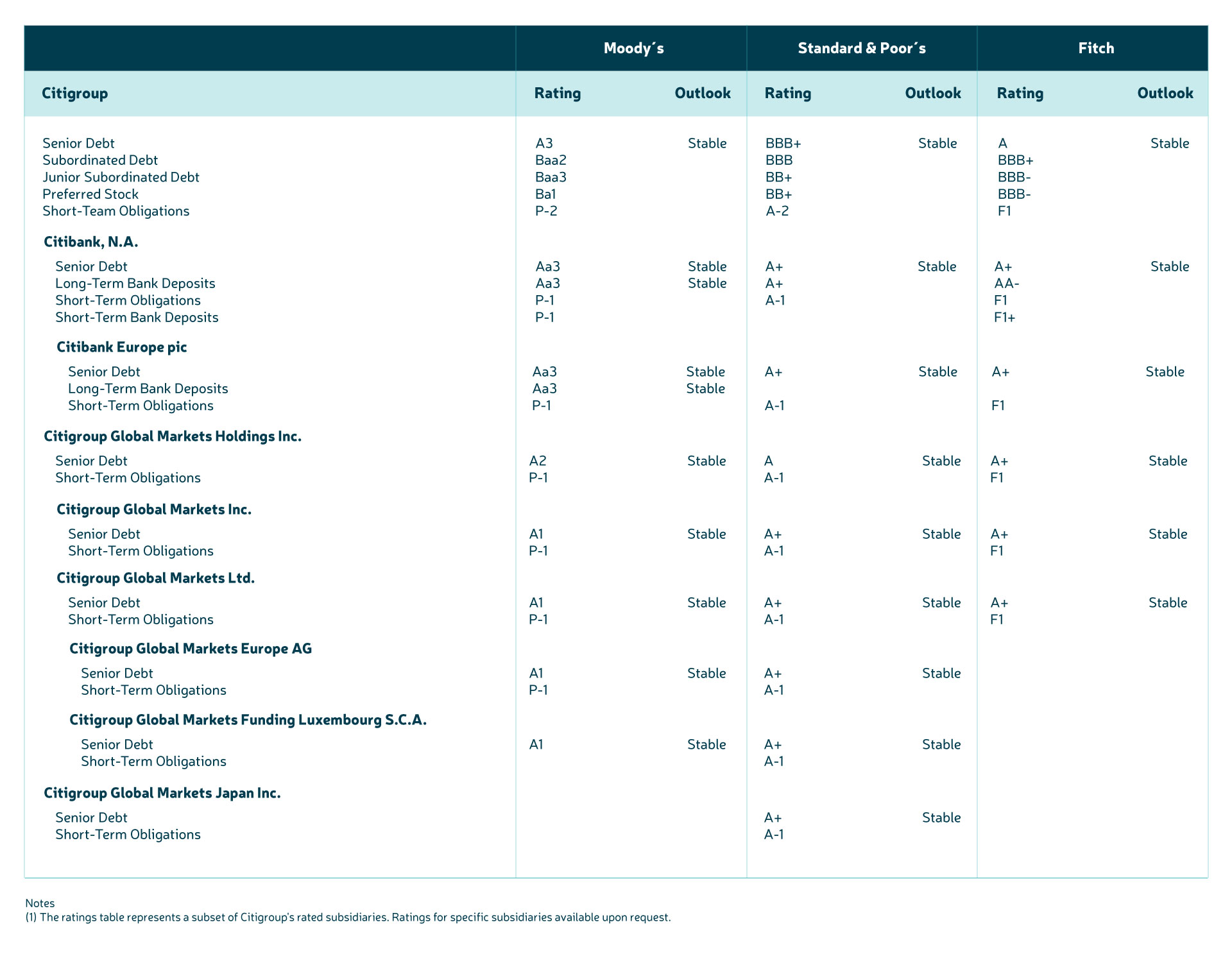

Citigroup Local Custody Rating:

Rating as of : January 16, 2024.

Citigroup Global Custody Rating: