Our Value Proposition

A single integrated platform with multiple functionalities

A single integrated platform with multiple functionalities

Full scale Depositary Bank services for Luxembourgish Collective Investment Schemes under UCITS and AIFM directives, spanning liquid and illiquid investment strategies, served by a multilingual team, closely cooperating with fund promoters and trusted servicing partners which can be group related (Adepa Asset Management) or independent ManCos/AIFMs.

A truly global platform for collective schemes with a single entry point to access Investment Funds, ETFs and Spanish pension funds, linking asset managers and distributors, and providing optional ancillary services such as funds analysis & selection and other value added services (searching tools, ESG scoring. etc). More information here.

Brokerage of equities, fixed income, derivatives & currencies via the Inversis platform and possibly via the trading desk of Inversis Madrid.

A full offer for institutional asset managers: banking relation, including routing and execution of orders, settlement of operations and custody of financial instruments holdings (inclusive of the management and administration of corporate actions).

Global Offering

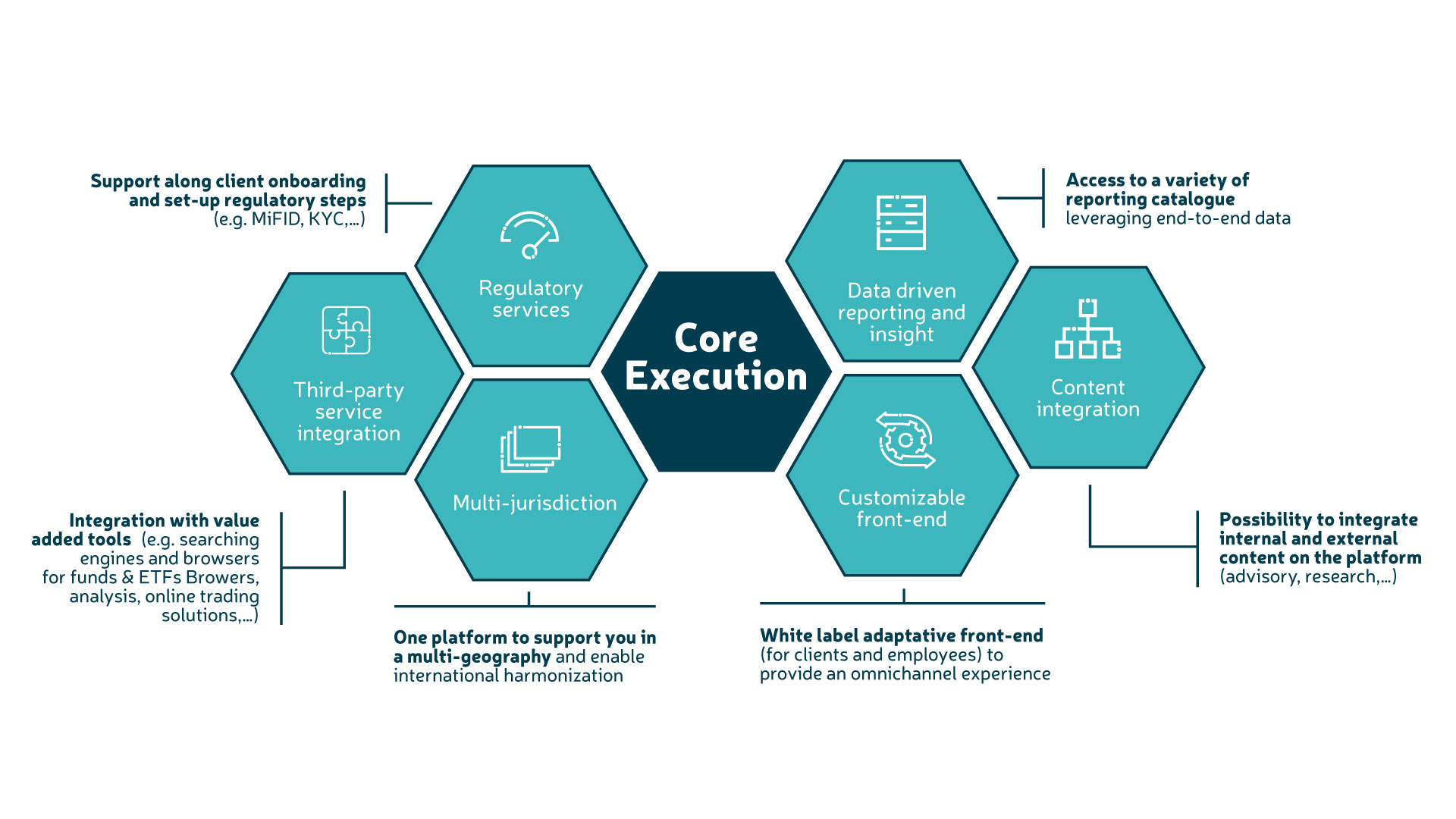

• Full suite of investment products and services available in one platform• Modular & scalable offering• Multiple alternatives & features of customization. Because, your success is our success!

Outsourcing

• Pay per use model• Clients benefit from:• Reducing low value added tasks• Decrease maintenance costs• Flexible strategy to face a changing and expensive regulatory environment

Open architecture and technology

• White labelling• Mobility solutions (apps, smartphones, tablets, etc.)• Real time • 24*7*365 availability based on a hyper convergence architecture

Added value

• Specific service modules:• Fees & Charges Manager applicable to end-clients• Regulatory reporting• MiFID II service packages

Business processes core execution is supported by value added services that can be plugged or developed along the value chain.